In today’s business world, apart from many other things, you should follow various complex tax laws. Taxation regulations in any country are complex and only for some. In a business, you have money from every head except ‘money from Salaries.

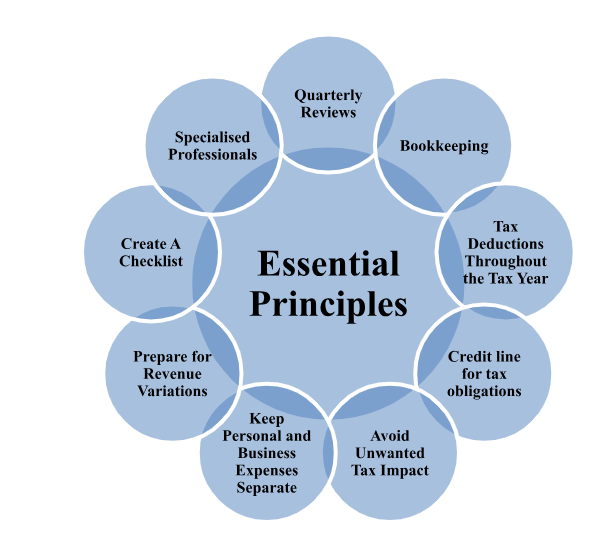

Top list of Principles that Every Business Owner:

If you are unaware of tax-saving opportunities, you may have to pay large taxes to the government. However, this writing will tell you about the principles that business owners must know. It will help you to avoid paying unnecessary taxes.

Conduct Quarterly Reviews:

Consider doing quarterly financial audits. Examine your profit and loss account and all your company’s expenses. As tax paperwork arrives, collect and store them.

Get Your Bookkeeping Done ASAP:

Bookkeeping and financial statement preparation are independent of completing the business tax return. An accounting firm can usually do both. But it prolongs and complicates the procedure during the busy season. Have your whole year’s books reviewed by January or quarterly. Apart from this, remember to record your expenses like salaries; that’s why pay stub creation is of utmost importance in business.

Look for Tax Deductions Throughout the Tax Year:

Most of the business owners look for tax deductions after the fiscal year is over. But the tax year is the best time to make allowable deductions and decrease your taxes.

Get a Credit line for Tax Obligations:

Tax season can be stressful for your business, but that doesn’t mean everything else stops. You’ll still need to fund overhead, wages, and other expenses. So, accessing a line of credit allows you to meet unexpected bills. You can opt to use the remaining funds for business expansion.

Avoid Unwanted Tax Impact:

You can never avoid paying taxes. A business owner should be ready when the time comes. We propose that you have a good connection with your tax accountant. Keep communication open by meeting with them regularly rather than annually. It will help you reduce surprises and reduce stress during tax season.

Keep Personal & Business Expenses Separate:

Throughout the year, keep all personal and business expenses separate. If you run a small business, use your business credit card for all transactions. This way, when the time comes to submit your personal and business taxes, everything is ready.

Prepare for Revenue Variations:

The prospect of having to write an IRS cheque is stressful. However, to avoid this, firms should set aside 10% more than they expect to pay in taxes. Besides that, support, consider an increase in payments in December. Also, consider what your partners are doing to decrease their tax liability. Look for chances to use similar practices with your company’s providers and partners.

Create a Checklist Using Last Year’s Documents:

It takes time to gather your tax records. It’s all too simple to miss something. Gather last year’s records, then consider what is different this year. You’ll be in good shape once you’ve collected that difference.

Working with Specialized Professionals:

Engaging a certified tax advisor with experience can help you in many ways. It will help you understand the complex tax rules. Also, ensure you use all possible tax-saving techniques. They can also help with compliance requirements, company structure, and planning. It will also provide insights into new tax legislation and its impact on your firm.

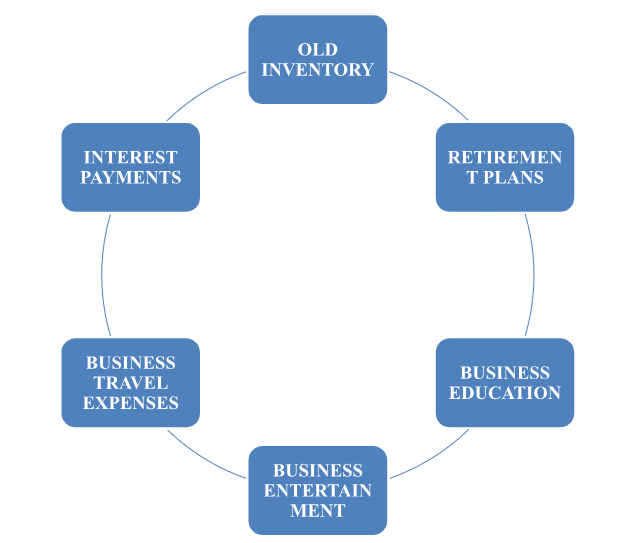

Few Tax Exemptions For Business Owners:

Let’s now examine a few tax exemptions available for business owners.

Remove Old Inventory:

If your business deals with physical inventory, late December is the best time to remove them. You can remove the inventory that has become outdated or damaged during the year. An ERP Accounting system can help manage inventories, costs, and equipment. They also help in preparing for filing and maximizing deductions. Any decrease in the market worth of these old assets leads to deductions for your company. But many business owners try to stretch the definitions of “damaged” and “obsolete.” It is beyond what the IRS would accept.

Contribute to RetirementPlans:

Tax-exempt retirement plans are among the most powerful tools in a small business’s tax avoidance inventory. If you want to increase your taxable income in late December, consider the company’s 401(k), IRA, KEOGH, or SEP. All these small business tax ideas avoid taxation in some way. If you can max out your permissible yearly contribution, you will avoid paying taxes on the entire amount of your revenue.

Write off Business Education:

Work-related education expenses are one of the most neglected tax deductions. If you return to college for a management degree to increase your marketable abilities, you may be eligible to deduct these expenses. But it does not include schooling intended to prepare you for new employment. This tax benefit for small businesses only applies to schooling, which also improves your chances in current company ventures.

Deduct Business Entertainment:

The IRS allows business owners to deduct some business entertainment costs under strict guidelines. The general rule is you should do your business while enjoying the entertainment. For example, for a catering meeting in your conference room – you may deduct 50% of such costs. When it comes to entertainment deductions, be aware that you need documentation. For instance, if you had a business lunch, write “lunch with Randy Marsh of Entourage Group for affiliate marketing proposal” on the receipt.

Business Travel Expenses can be Deducted:

It’s a good idea to arrange future business trips by the end of December to maximize SMB tax savings. It’s also worth noting that you can deduct business travel anytime. You can deduct it if the deductions are for business-related expenses. It includes plane tickets, taxi services, motels, food, and Internet access.

Interest Payments are Deductible:

Many tax suggestions involve using credit funding for small business models. The associated fees are fully deductible for such business owners. SAAS Accounting software for cloud computing may help you. It ensures that your deductions include all interest, fees, and carrying charges related to any debt financing your firm uses. Taking out personal loans and using the revenues for business purposes follows the same tax advice for small businesses. Again, maintaining correct records is essential. Keep the IRS from pushing you into a position where your only option is to declare that you paid all the interest you claimed on the return. Maintain a document to prove that you are claiming tax deductions used in your firm.

Final Words:

Finally, managing organizations as successful business owners can take time and effort. But, with the proper knowledge and methods, you can reduce your tax liability. Also, increase your financial performance. Moreover, feel free to seek professional help to maximize your tax preparation efforts.