The Best Budgeting Apps Of 2022

As people around the globe continue to wrestle with financial crises and uncertainties caused by the pandemic, effective budgeting is one of the best ways to stay on top of personal finances. Using a manually prepared budget plan is no shame, but the use of a budgeting app provides you with greater convenience and many other benefits. Modern budgeting apps have become an effective way to keep proper track of personal spending and savings.

What Does Budgeting Apps Do?

Budgeting apps allow you to track personal finances on the go by eliminating the barriers of time, location, and resources. They give you a clear picture of what you earn throughout the month, what you spend, and which expenses should be eliminated to save more bucks. All budgeting apps are designed for creating personal budget plans and come with unique features and options. They help you make necessary changes in your budget plan in real-time to build strong financial habits.

What is the Difference Between a Budgeting App and Accounting Software?

Budgeting apps are designed for mobile devices like smartphones or tablet PCs. And help users create personal budget plans anytime anywhere. On another hand, accounting software is designed for desktops and cannot be used on mobile devices. However, some accounting software is designed for cross-platforms. This helps users access the software by using different devices. Accounting software is expensive and one may need technical skills to operate. But budgeting apps are easy to master and are mostly free of cost.

Benefits of using Budgeting Apps

Budgeting apps allow you to create and adjust budget plans whenever you need them. Since they can be installed on your smartphone, you can access your budget plan anytime anywhere without facing barriers of time and location.

Effective use of a budgeting app keeps you from running out of money when you need it.

A budgeting app keeps your budget plan with you so you don’t build bad spending habits. As a result, you don’t get into debt and are able to save bucks for emergencies.

Some budgeting apps help you pay bills online to build good credit scores. With better credit scores, you can get better rates on personal loans and credit cards.

A budgeting app can also send automatic alerts to help you avoid overspending and stick to the budget plan. Some apps also generate alerts for unusual transactions to detect frauds earlier.

Best Budgeting Apps Of 2022

With plenty of budgeting apps available these days, it can be daunting to go with a suitable option. To help you make an informed decision, we have created a list of the best budgeting apps of 2022 available in the market. So, you can choose the right one as per your budgeting needs.

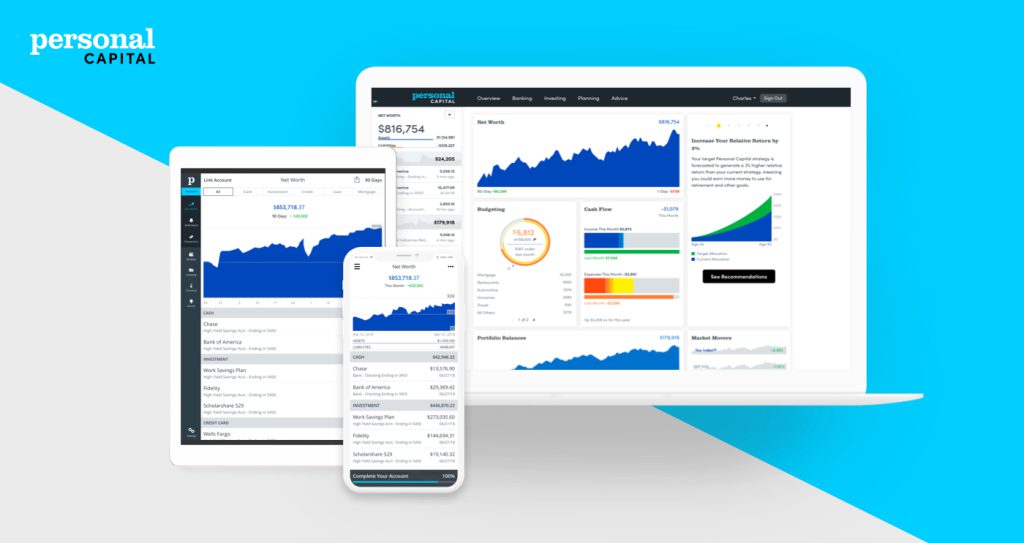

1 Personal Capital

Personal capital has earned the top position in our list of the best budget apps as it comes with plenty of budgeting features and options. The app offers excellent reporting features, desktop capability, spending tracker and investment management, etc. The personal capital budgeting app provides an all-inclusive view of users’ entire financial picture, from personal daily spending to portfolio performance.

The app comes with many other savings tools that can be used to create retirement savings, personal emergency funds, and debt repayment plans, etc. Other financial management tools like investment checkups, investment advisory tools, cash flow tracking, and education expense planning make the app an excellent choice for people of all ages.

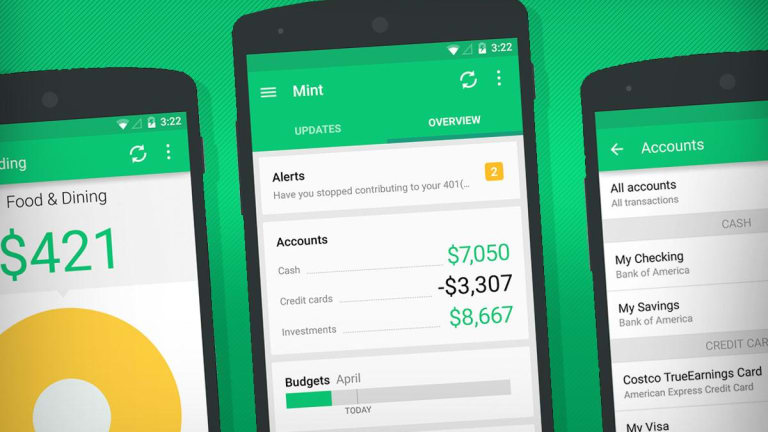

2 Mint

Mint is the oldest but excellent budgeting solution for all. The app is developed by the company ‘Intuit’, which is the parent company of popular accounting tools Quickbooks and TurboTax. It is designed to help users track and manage money from several banks, financial institutes, lenders, and credit card issuers.

It is more than a budgeting app as it automatically categorizes financial transactions conducted through different accounts, credit cards, or debit cards. Then it tracks those transactions against your budget plan so you can make necessary changes as needed. The app also generates alerts for you when you go over the created budget plan. You can also track your spending by category to get a holistic picture of where your money goes.

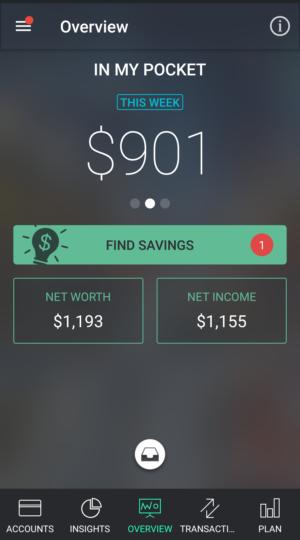

3 PocketGuard

As its name shows, the PocketGuard is a budgeting app that helps you guard against overspending during the month. You can easily link the app to your bank accounts and cards to track spending compared to a created budget plan. PocketGuard is very easy to set up and use. It effectively tracks how much you are making every month, and where you are spending all your money throughout the year. The best thing about this budgeting apps is that it helps you find opportunities to save whenever possible.

4 YNAB (You Need a Budget)

YNAB or ‘you need a budget’ is one of the best budgeting apps and helps users a lot in saving money and getting out of debt. The app doesn’t use insights from the past but focuses on the current situation of the user and future possibilities to manage finances efficiently. YNAB also helps users figure out financial priorities and personal financial goals. As a result, they can better plan their money to save more without getting out of money at the end of the month.

Personal financial goal tracking, reporting, spending habits tracking, and real time customer support are some excellent features of this budgeting app. Whether you want to stay on budget, save more, or pay off debt, YNAB would be a wise choice for you.

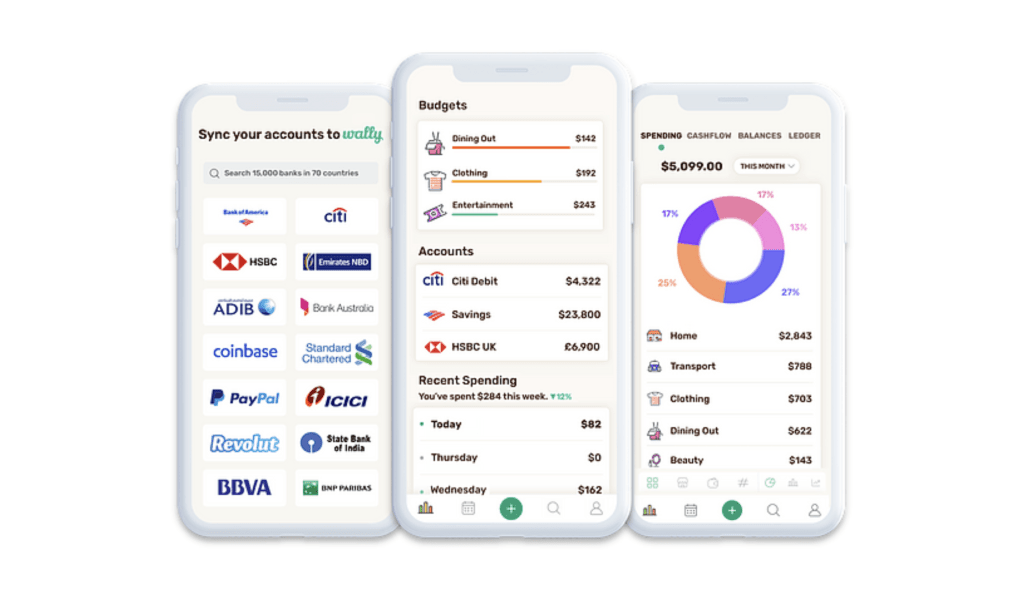

5 Wally

Wally is one of the best apps for budgeting. The app allows you to keep proper track of monthly earnings and expenditures while providing you a clear picture of the remaining money so you can prevent overspending and build strong spending habits.

Wally is a freemium app. This means, you can use its free or paid version as per your budgeting needs. The app’s built-in support for foreign currencies makes it a superb budgeting app for people around the globe.

6 Goodbudget

The envelope budgeting system is one of the traditional budgeting methods to manage personal finances and save money. The GoodBudget app uses the same formula to help you budget and save digitally on your smartphone. The app can also be used to manage shared budget plans as more than one user can sync their plans with one another.

Furthermore, Goodbudget also provides its users with budgeting education and resources like podcasts, Bootcamp webinars, and blog posts. This keeps users informed about the latest budget methods and trends in the financial industry.

7 Mvelopes

Mvelopes is another best budgeting app that provides cash budgeting methods but in an advanced format. The app enables you to connect different financial and bank accounts and put them all into traditional envelop budgeting style to track daily spending. As a result, you can have a clear idea of whether you can get your favorite coffee this month or you need to wait for the budget to restart next month. Mvelopes helps you avoid overspending and save some bucks every month to build an emergency fund or grow your savings account.

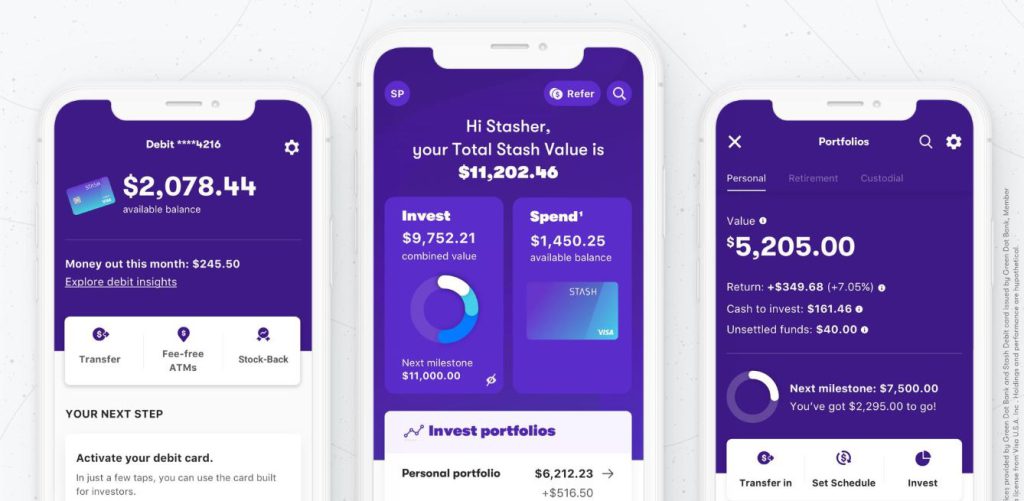

8 Stash

Stash is more than a budgeting app. It provides quick access to several features like budgeting tools, a taxable brokerage account, a digital checking account, and a debit card that helps you earn stocks whenever you use them. The budgeting portion of the Stach app allows you to track your spending and you can also set personal financial goals like savings. The app also helps you automate savings and investments. Since it comes with a checking account and passive saving features, there is no minimum balance requirement, hidden fee, or overdraft fee.

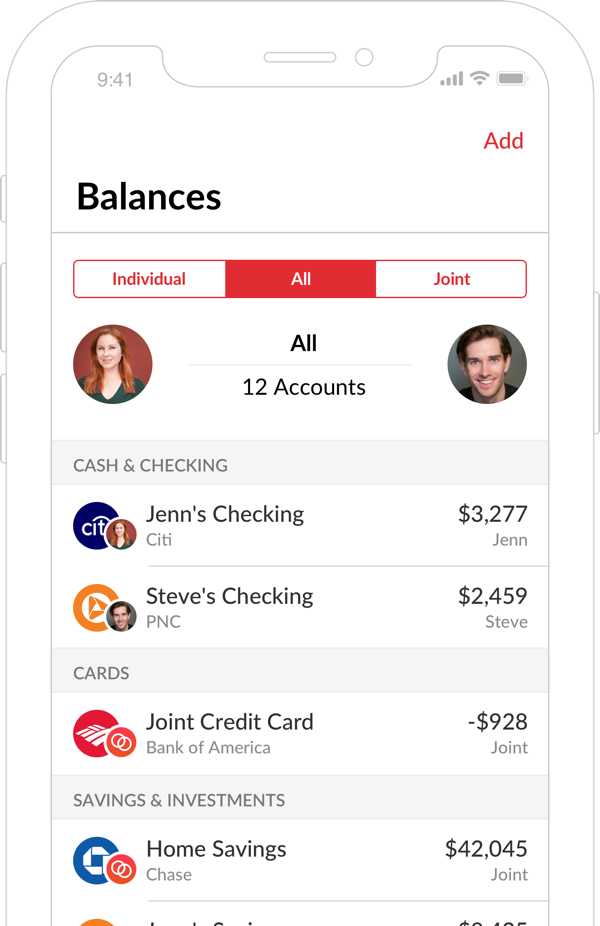

9 Honeydue

Household finances are an important concern for newlywed couples. The Honeydue app allows couples to manage their finances effectively while staying in touch with each other at the same time. Instead of making calls or sending text messages, couples can communicate with each other within the app to stay on top of personal finances. The app also helps set bill reminders and payment notifications so couples can communicate easily about bill payments. Furthermore, both parties can also determine who will be responsible for a particular expense. Bank account integration is required to get started with this budgeting app.

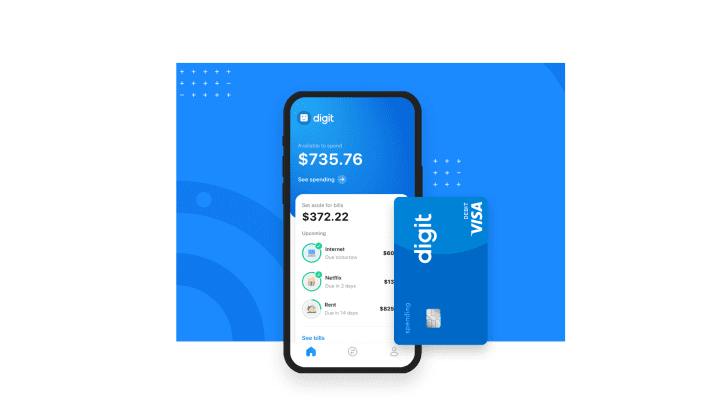

10 Digit

Do you really want to make budgeting and saving money less of a hassle? Digit is here to help. Digit is one of the best budgeting apps designed with machine learning technology to guide users hit their financial goals effectively. Whether you want to stay on top of monthly expenses, build an emergency fund, eliminate debt or build a down payment for a new car, the Digit budgeting app can support you in your financial objectives.

The app automatically calculates an apt amount of money to be deposited in your savings or retirement account. All you need to do is submit goal details like who much you want to save and the date you want to reach the goal. The app will put savings on autopilot to take the task away from you.

How to Choose a Budgeting App?

Choosing the best option out of the available best budgeting apps seems like a small financial decision as compared to others. Choosing the right budgeting app can make a huge difference in your financial phase of life. The right app for budgeting allows you to get useful insights and data into your personal incomes, expenses, and savings in real time.

Below are some important things to consider when choosing a budgeting app to manage your personal finances more efficiently:

Features

There is a huge number of budgeting apps over the web and each comes with unique budgeting features and options. It makes sense to test different apps to figure out which one is best for you and fits your individual budgeting needs. The best features in leading budgeting apps in 2022 include:

- Creating budget plan

- Connecting all your accounts

- Bill payment reminders

- Credit score tracking

- Spending tracking

- Setting financial goals

So go through the list of features before you sign up for a budgeting app.

Fees

Not all budgeting apps are free and come with different pricing plans. Some are free, some premium, and some freemium (offer a free version with fewer features). Before you choose an app for personal budgeting, make sure you are aware of all the monthly fees and other financial charges if any. If you are about to use a paid budgeting app, make sure it has all the necessary budgeting tools and features that are worth the investment.

Security

Security of all your financial and personal information should be on the top. Since you may need to connect your bank accounts and other financial logins to the app, make sure the app has a superior level of security. Before you sign up, check the level of security, encryption, and other security features to ensure all your personal and financial details will be protected. 256-bit encryption, multi-factor authentication, and advanced login features like fingerprint and facial recognition are some important security features to check in your budgeting app.

Customer Support

When you encounter an issue while using your budgeting app, having 24/7 access to the support team is useful. So when choosing a budgeting app, ensure there is an active customer support team that addresses consumer queries and issues in real-time. To make the right decision, go through the customer reviews and feedback to check users’ experience with the app before you consider it.